How NPS calculated ?

Introduction

Before you reading this article, I am sure you heard about NPS. And you must be curious about how NPS helps. Is it a savings plan or an investment plan, how it impacting your hard earned money , Is it helps to save or multiply and grow your money .

So the very first question should be

What is NPS ?

Full form of NPS is national Pension Scheme This scheme was launched in 1995 by Government of India. The main objective to this scheme of Government of India is to provide a particular secured pension fund after retirement by investing money in various Fund management Company through a mode of SIP (Systematic Investment Plan).

Difference between NPS & EPF

Both schemes are applicable and useful for a salary employee. Click here to understand the difference.

How NPS works ?

NPS works in alignment with stock Market. The money collected from NPS holder is invested by Fund Manager in Share market. After investing in a long term, fund grows in compounding way. Finally the end corpus is distributed to NOS holders in two forms, one in lump sum meaning 60% of corpus is given as lump sum and second 40% of corpus is deposited in annuity Plan to provide a recurring income to NPS holders every month.

How NPS calculated ?

Calculation of NPS depends on regular monthly contribution, term of investment, annuity percentage. According to choice of person Pension amount of NPS results.

Click Here to for better understanding.

How NPS calculated from Salary ?

Employer deduct 10% of Basic Salary as NPS contribution. Every month deposit this amount to NPS fund. NPS contribution up to 10% of Basic salary can be deductible from Taxable Income up to 7.5 lakh per annum. The contribution amount is shown as retiral benefit to employee in the CTC letter of employee.

How NPS pension is calculated ?

At the age of 60 pension is decided as per choice of lumpsum amount and annuity plan and percentage. If one choose to withdraw maximum amount as lumpsum then pension amount will be reduced. To maximize pension one need to maximize to annuity percentage and divert maximum amount into annuity plan.

How NPS contribution is Calculated ?

For deciding or calculating NPS contributions there is no specific formula available. It depends on the individual member how much amount he or she is comfortable to provide as Contributions.

In NPS Scheme there is 2 accounts available. Tier I and Tier II. In Tier I you can choose 5% or 10% of your basic salary to deposit as contributions Every month. This is regarded as Corporate account. In Tier I you can deposit up to Rs. 50,000 per annum. This amount can be saved from Income taxes under section 80ccd.

How NPS is deducted ?

If you are an employee and you declare your employer to deduct let’s say 10% of your basic salary then your employer will deduct that amount as NPS contributions and deposit to your Tier-I account.

How NPS amount can be withdrawn ?

How NPS interest is calculated ?

Interest rate of NPS is calculated based on performance of Stock Market. If the fund manger has allocated your fund into those company who has done extremely well in that year, then your return will be good. If those company has not done well , then you will incur less return. Generally it varies 6% to 12% as per historical data.

How NPS works for government employees ?

After removal of Old pension scheme, Government of India has introduced New Pension Scheme, where employee contribute for the NPS and the double amount is paid by government as contribution to the NPS account of same employee. Possibility of return and rate of interest are same as others.

How NPS annuity works ?

After maturity, lumpsum amount and annuity amount are segregated on 60: 40 ratio on mandatory basis. However there is option to increase annuity plan to incur high pension.

How NPS helps to save Tax ?

By investing in NPS a employee can save extra Rs 50,000 under section 80ccd. Apart from Rs.1.5 Lakh under Section 80C an employee can save tax extra. Employee save some amount of money from his/her salary and deposit it in NPS in every month on regular basis.

How NPS corporate account helps ?

When a employer deduct some amount from one of the components of Salary structure and deposit in NPS account as retiral benefits. Then Taxable income of employee is reduced so ultimately incur less tax.

What is the role of Fund Manager in NPS ?

The fund manager allocates NPS amount as per market rate in various sector. After 15-20 year the employee will get the return as per market rate.

How much NPS can be withdrawn after retirement ?

60% of the total amount will be drawn by the employee from the NPS as lumpsum amount. And the remaining 40% amount will be fixed into an annuity plan. From that annuity plan the employee will get a monthly pension on regular basis after retirement.

Many of employee doesn’t know about the NPS scheme. So most of the employees did not do with their employment life. At the end of retirement, they did not get anything left in their bank account. In the beginning of the employee life an employee must do a NPS scheme. The magic will be reflected in a long run. The final corpus will be giving a handsome return in their after-retirement life.

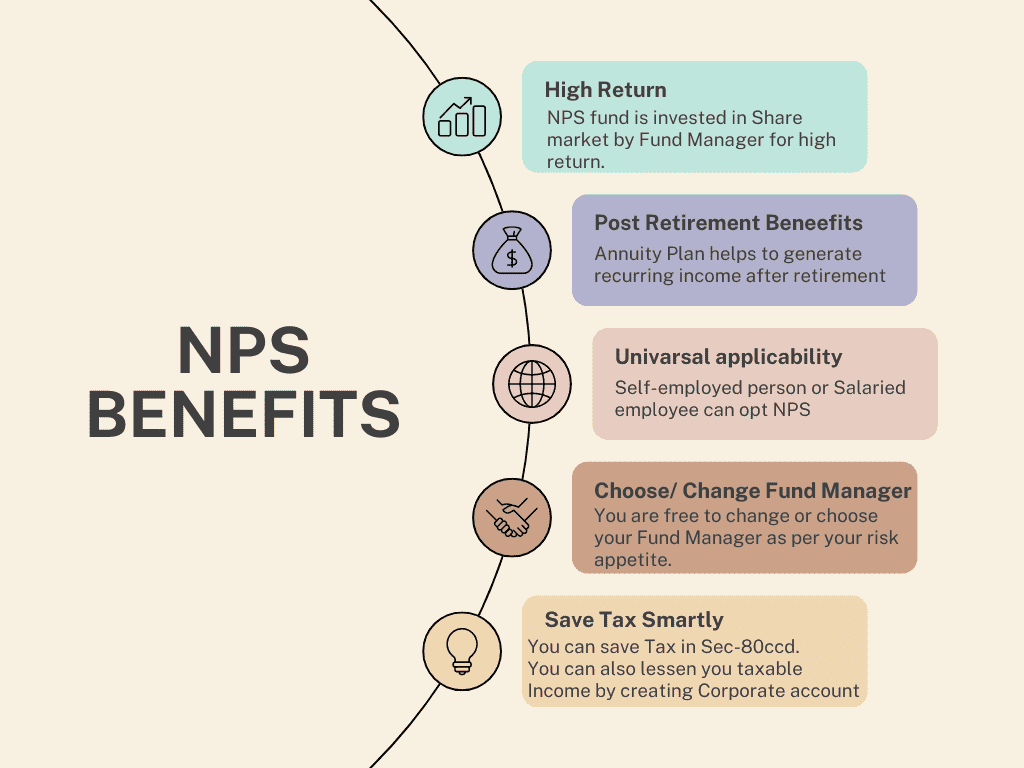

Benefits of NPS

What is NPS Scheme and its benefits ?

Below mentioned top 5 benefits of NPS scheme

Income Tax benefits– A person can save extra ₹50,000/- under NPS scheme in addition to ₹1,50,000/- as Tax benefits.

High Return- In NPS scheme an employee get High return because all the deposited funds are linked to stock market. With the sudden growth of stock market the money grows in a speed movement.

Option for recurring income– As per Provision of this scheme you have to 40% of your maturity to be allocated to an annuity plan to get pension as a recurring income.

Post retirement Pension benefits– NPS is designed to provide Pension benefits after retirement. If any person wants more pension post retirement then he or she can contribute more to the annuity plan to get more pension.

Free choose to Fund Manager– One has the freedom to choose Fund manager. This helps to make a difference in to get the profit margin.

Why NPS is important ?

NPS is important because it serves high returns and tax benefits which is an important to grow your money in Indian market. NPS also provide both lump sum and recurring income at the time of maturity to the subscriber.

What is NPS Tier 1 account ?

In NPS Tier 1 accounts your employer deposit monthly contributions by deducting it from your salary. Profit is same for both accounts.

How NPS Tier 1 accounts helps to save Tax ?

The amount is deposited in Tier 1 account is by lessening one of the salary component say, Special allowance or retaining allowance. Thus taxable income is reduced and less tax incurred.

What is NPS Tier 2 account ?

In NPS Tier 2 account you deposit ₹ 50,000 every year. You gain Tax benefits under section 80ccd.

When NPS is launched ?

NPS was launched in the year 1995.

NPS Process :

How to open NPS account ?

Steps followed to open NPS account:

Step-1 : Log in to eNPS website, choose National Pension Scheme, Registration, Click on Individual.

Step-2 : Enter your PAN Number and other details. Verify your PAN number by entering OTP received into registered Mobile Number into Aadhar.

Step-3 : Choose your preferred account. Tier-I or Tier-II or both. To enjoy both you have to create Corporate account or you have to open Tier-I and then transfer it into Corporate account.

Step-4 : Choose your Pension Fund Manager from the list. Fund Manger will alocate your contribution fund. So choose wisely.

Step-5 :Chose your Investment Mode. There is two mode, Auto Mode and Active mode.

Auto Mode: Equity allocation is done automatically

Active Mode: you have the control for equity allocation.

Step-6: Mention name, age details of nominee you wish. You can share nominee percentage. Your nominee will receive the whole corpus after your death.

Step-7 : Upload the desired documents like PAN, passport size photograph, Signature. Ensure the size of document shall be less than 12 kb.

Step-8 : You have to make payment initially to complete the registration process. For Tier-I , Rs. 500 and for Tier-II, Rs. 1000 to be paid first.

Step-9 : You will get auto filled registration forma after sucesful payment. Download and take print of it.

Step-10: Send the form to registered address with PRAN Card document. To complete the registration process, email registration form with photo and signature and PRAN document to CRA( Central recordkeeping Agency within 90 days of opening of NPS account.

What is NPS PRAN ?

PRAN is a 12 digit number identifies those individual who are registered under and became active member of Nation Pension System.

What is the Full Form of PRAN ?

PRAN- Permanent Retirement Account Number

What is the purpose of PRAN card ?

PRAN number identifies NPS member, tracks pension contribution, access NPS benefits.

What is the maturity period of NPS ?

Maturity period of NPS is 60 years.

Can I withdraw money from NPS ?

You can withdraw money from Tier-II account, but to withdraw from Tier-I account you have to wait for the maturity.

What is the lock in Period for NPS ?

Generally 15-20 years is the lock in period of NPS.

How much pension is given in NPS ?

Minimum pension amount is Rs.9,000 and maximum will be Rs. 1,00,000

Is NPS better than PPF ?

What documents required for creating PRAN ?

What documents required for starting NPS ?

Below mentioned documents are required,

- PAN

- Aadhar

- Registered mail id & mobile Number

- PRAN number

- Passport Photograph

- Digital Signature

What is NSDL ?

NSDL is National Security Depository Limited.

In which website we can create PRAN ?

In enps.nsdl.com website we can create PRAN.

What is NPS corporate account ?

Once you are salaried professional then you create your NPS corporate account from your employer . This account will you to deposit some percentage of your salary into NPS every month. The benefit is to reduce Taxable income.

How much amount we can save as Income Tax under Sec 80CCD through NPS ?

You can save ₹ 50,000 per year under section 80CCD by investing in NPS.

How NPS helps an employee ?

NPS helps an employee in various ways as mentioned below,

- To invest with discipline

- To save Tax

- To expect high return

- To ensure pension after retirement

- To choose or change Fund Manager wisely

- To reduce Taxable income by creating corporate account.

What is NPS maturity period ?

Maturity period of NPS varies from 15 years to 20 years.

What is NPS rate of return ?

Generally NPS rate of returns is varies from 8% to 12%. Rate of return of NPS is actually varies. As NPS is linked to stock market its return is expected to increase or decrease as per reaction of stock market.

When can NPS started?

Anytime NPS can be started but before one need to create a PRAN number.

Who are eligible for NPS scheme?

Any salaried employee and self employed person can be eligible for NPS Scheme.

How NPS is different from EPS ?

NPS is completely different from EPS. NPS is coming under NSDL whereas EPS is coming under EPFO. Only employee can invest in EPS whereas anyone can invest in NPS.

When NPS can be withdrawn ?

After maturity of NPS you can withdraw NPS amount. 60% will be withdraw as lumpsum and 40% will be kept as annuity plan to incur Pension on monthly basis.

What is NPS initial plan amount ?

Who controls NPS ?

What is Protein app in NPS ?

What is NPS contribution ?

How to get 30,000 pension per month ?

Can NPS be paid monthly ?

Yes, NPS can be paid monthly by employer to deposit in Tier II account.

Can I exit from NPS after 1 year ?

Yes, You can exit.

How we can save income tax by investing in NPS ?

Under Section 80CCD we can save of Rs. 50,000 per year

What is good NPS Fund Manager ?

Generally HDFC Bank and Kotak Bank is regarded as good NPS Fund Manager.

Which type of NPS is best ?

There are two types of NPS. Tier I and Tier II. Both have their own benefits. Rate of return of both are same however it capable to save tax in invested smartly.

Is NPS risk free ?

No, some how risk is attached to NPS because the expected return is linked to Share Market condition. That means is market is doing well then NPS return is handsome if market is going down then NPS return will be less attractive.

Conclusion :

No doubt NPS is a beneficial scheme. Here the important point is it is a high return scheme as it is linked to stock Market. One should keep in mind about Fund Manager and keep on invested for long term.