EPF Declaration :

Now a days most of the employees have high basic Salary. High salary varies company to company. Actually salary ceiling of employee provident Fund is Rs. 15,000 per month. When employee gets more salary than PF ceiling, he or she is not eligible for EPF scheme.

So here comes the importance of EPF Declaration for employer. Let us understand these below questions one by one to understand the concept of EPF consent from employee.

What is EPF declaration form?

It is simply a document to collect agreement of employee to become a member of EPF Scheme. When a person starts joining in Organisation or switch job from one organisation to another Organisation at that time of joining the concerned employer ,you may say HR Executive required declaration Form from the newly joined employee .

In this form the details like previous Organisations EPF ,UAN number,Nominee Name etc. of the employee is required to update in the system.

What is Joint Declaration Form ?

In case of any spelling error of name or Father’s name,correction of date of birth of epf member is found, and epf member can not access UAN portal to change those, then employee need a joint declaration form to change those details by signing both employee and employer and sent to PF office.

How to download PF joint declaration form ?

PF Declaration form pdf

PF joint declaration form pdf

How joint declaration form helps an employee?

Well, it helps may way.First it will help to update Correct KYC of employee. Second it helps to verified by employer.Third it is done in online mode .Fourth it is done within less time and hassle free way.

What is the process of Joint Declaration form submission?

Ok, follow the below process to understand process

1.Collect the form from HR executive of your company.

2.Fill it appropriately and sign.

3.Submit the hard copy to HR executive.

4. HR executive will ensure the Signature of employer from authorised person.

5.He will update it in Employer side UAN portal by providing appropriate reason.

6.Your information will be corrected after approval of EPFO.

What are the potential reasons for Joint Declaration?

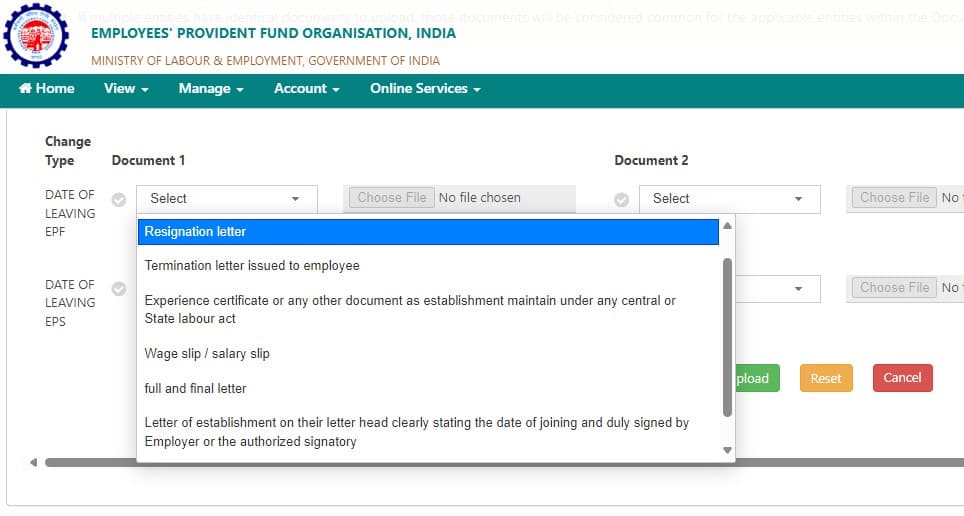

Attached below a image to understand the possible reasons for joint Declaration form as provided by EPFO.

How many days required to update Joint Declaration form ?

It depends upon the concerned employee and the HR executive of the Organisation on what pace they update in the portal. Then EPFO may take 1-2 week to approve and update in the portal.

Why EPF declaration form is important ?

It is important because it carries all the relevant information of the concerned EPF member and most importantly consent of the member also taken into consideration.

Why Consent is Important from Employees?

Consent of employee as well as employer is important because in future Declaration form serve as a document in court of law in case of any litigation .

Procedure to Submit EPF Declaration :

Joining of Employee- Verification of Basic Salary-if more than ₹15,000 per month-Employer provides EPF Declaration form-Employee fill all the required details-Put final Signature after reading all Information-Submit filled form to Employer-Employer update the same in EPF portal (Employer Desk)

When EPF Declaration is required ?

When a person starts joining in Organisation or switch job from one organisation to another Organisation at that time the concerned employer required declaration Form from the person.

Is it mandatory to submit EPF declaration form ?

Yes, it is mandatory as it carries all the relevant information of the concerned EPF member and most importantly consent of the member also taken into consideration.

What is the difference between EPF nomination form and EPF Declaration form ?

Well, In EPF nomination form you are nominating your family members to avail PF benefits in your absence whereas in EPF declaration form you are submitting your consent and previous employment details if any to your employer for future EPF contribution.

Whom we shall submit EPF declaration form ?

Newly engaged employee or the employee switch his/her service to a new Organisation should submit this form to the Concerned person of the Hiring Organisation at the time of Joining.

What is the information available in EPF declaration form (Form 11) ?

The information is given below:

Name, date of birth, date of Joining, age, Mailing Address, Father’s name & address, Previous UAN number in case of job change, Previous EPF/EPS number, Date joining & Date of Exit of Previous Employer, Declaration statement acceptance.

What is Form 11 in EPF ?

Form -11 is the document to obtain consent of employee to become a member of EPF,EPS and EDLI scheme is taken.

When a person starts joining to a new Organisation or switches job from one organisation to another Organisation at that time the concerned employer required declaration Form from the person. In Form-11 details of the particular employee are required to update in the system..

Why Company want EPF Declaration ?

Company wants EPF declaration so that an employee can not file complain against employer for illigal deduction of salary in the account of EPF scheme. So for safeguard of employer company keep record as written consent from employee.

In what case EPF Declaration not required ?

When employees salary is less than Rs. 15,000 per month that means legally a person is regarded as employee as per the definition of EPF act. At this situation, there is no importance to keep a record for employer to obtain EPF Declaration from Employee.

What are the important information available in EPF Declaration ?

Below information are mentioned in EPF declaration.

- Name of Employee

- Date of Joining

- Date of Birth

- Father’s Name

- Employee address

Is previous employment details to be updated in EPF Declaration Form?

Yes, Previous employment details like UAN number,PF number,Pension number,Name and location of Previous employer to be updated in EPF declaration form.

How employer receives consent of employee for EPF contribution?

At the time of joining employer provides EPF Declaration form to collect correct information about EPF of employee and receive consent to become EPF member.

What is the salary limit when EPF declaration form is not required?

If employee is earning Rs.15,000 per month then he or she is under mandatory provisions of EPF scheme.In this case employer should not need EPF declaration form to be signed from employee.

Do I need to declare PF ?

Yes. If your basic salary is more than ₹ 15,000 per month then you need to declare your consent in PF declaration form to your employer.

How to fill nomination and declaration to EPF ?

Nomination is filled in UAN portal and declaration is required to be filled in Form -11 and submitted to employer.