EPF Contribution :

When I say EPF Contribution, I mean the contribution go to EPF for Employee. It includes two share that is both employee share and employer share. One must know about the proportion of salary constitutes employee share and how much is employer share and how all contribution make sense for benefits.

To know more about EPF, Check out below link.

How to apply EPFO loan or advance ?

Truth about Higher Pension Scheme

How can I check my EPF contribution ?

You have to open your passbook, to check the monthly contribution deposited to your respective EPF account. Generally, SMS receive to the registered mobile number after successful deposit of EPF amount by employer.

EPF Contribution account wise details:

When employer deposit EPF Contribution to EPFO, money segregated to separate bank account. These separate bank accounts are created for smooth operation of money on different schemes of EPFO like, Provident Fund, Pension and Insurance.

Separate account helps EPFO to track and calculate correctly. Given below the percentage of EPF to various provisions of EPFO.

| Accounts of pf challan | Employer Contribution | Calculation |

| A/C no 1: PF contribution account | 3.67% | 15000*0.0367=550.5 |

| A/C no 2: PF admin account | 0.5% | 15000*0.005=75 |

| A/C no 10: EPS account | 8.33% | 15000*8.33%=1249.5 |

| A/C no 21: EDLI account | 0.5% | 15000*0.005=75 |

EPF Contribution breakup

EPFO has made different provisions for the employee. So monthly contribution deposited to EPFO is not deposited in a single account. EPFO controls different bank accounts for Provident Fund, Pension and EDLI.

So when a establishment submit contribution by generating challan, the money is segregated into respective account.

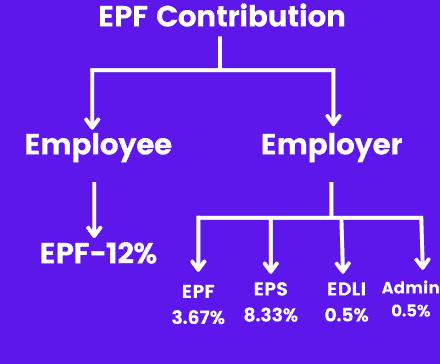

As per the EPF rule, 12% of the Basic and Dearness allowance is taken from the Employee that is called Employee Share.

And 13% of the Basic and Dearness allowance is taken from the Employer that is called Employer Share.

Among employer share the money is again divided. Like 3.67% is allocated to Provident Fund, 8.33% is allocated to Pension Fund, 0.5% is meant for EDLI and remaining0.5% is utilized by EPFO for administration charges like Official documents, formalities etc.

At the time of claiming, different forms and procedure to be followed for withdrawing fund from different account.

What is Employer share & Employee share in EPF ?

Both employee and employer for pay for EPF contribution. The amount given by employee called employee share, which is 12% of salary mandatorily, but still employee can contribute more than on voluntary basis. This extra contribution is call VPF.

Again the amount given by employer is called employer share i.e. 12% of salary. Here the employer also take charge to contribute for Insurance and EPF administrative charge, that is 1% of salary. So technically employer contribute 13% of salary.

How employer contribution is 13% ?

Employer contribution in Provident fund is 13%.Break up is given below,

Provident Fund : 3.67%

Pension Fund : 8.67%

EDLI : 0.5 %

Admin Charges : 0.5 %

Total Employer contribution : 13 %

EPF Contribution calculation

Lets say an employee is receiving Rs. 15,ooo as basic salary and dearness allowance.

His EPF contribution is as given below.

Employee share: 12% * 15,000= 1,800

Employer Share: 13% * 15,000=1,800

What is the meaning of EPF wages ?

According to Sec. 2 (b), basic wages include all emoluments earned by an employee in cash while on duty or on leave or on holidays with wages as per the terms of the contract of employment and excludes:

- Cash value of any food concession

- Dearness allowance

- House rent allowance

- Overtime allowance

- Bonus

- Commission or any other similar allowance

- Any presents made by the employer (Sec. 2 (b) )

What is EPF Contribution percentage ?

Total EPF Contribution percentage is 25%. If segregate each component, then it is as mentioned below:

- EPF= 15.67% ( EE=12%,ER= 3.67%)

- EPS=8.33%

- EDLI-0.5%

- Admin charges=0.5%

What is EPF Contribution deduction ?

EPF Contribution is deducted both from employee and employer. 12 % is deducted from employee. 13% is deducted from employer. As a wholesome 25% is deposited to EPFO after deduction.

Can employee deduct PF contribution after leaving service ?

See, Contribution of PF depends upon two fundamental factors. One is Employer and second is Salary or Wages. After leaving service both are not sustained. So employee PF contributions are stopped after leaving service.

What is ECR?

ECR is a receipt generated after deposition of EPF contribution to EPFO. Full form of ECR is Electronic Challan cum receipt. When PF deposited electronical this receipt is generated. It is a evidence that the employer has deposited the amount that has been deducted from employee salary.

What is PF ?

Provident Fund is a social security scheme where an employee contributes certain amount of his or her salary and same amount is contributed by its employer and deposited to Government so that in future in particularly after retirement he or she enjoy a big amount of money.

What is employee PF ?

The share of PF contribution given by employee itself is called Employee PF. Employee PF is 12% of its salary deducted by employer to deposit to EPFO.

What is employer PF ?

The share of PF contribution given by employer is called Employer PF. Employee PF is 13% of employee salary deducted by employer to deposit to EPFO. 1% is meant for administration charge for EPFO.

Whether employer can deduct employer share PF contribution from employee salary ?

No, Employer can’t deduct employer share and administrative charges of PF contributions from employee salary. If such thing happens it is deemed as criminal offence.

What is Pension ?

Pension is the scheme of EPFO where employee is beneficial to get a monthly recurring amount after retirement from job. The contribution for Pension is paid by employer every month. Pension contribution is 8.33% of basic salary of employee.

What is EDLI ?

EDLI is Employee Depository Linked Insurance. It is an insurance scheme made beneficial to employee dependents if any mishap happens to employee. 0.5% of employee salary is paid for its contribution made by employer.

What is VPF ?

VPF is Voluntary Provident Fund. This provision is made for voluntary contribution for employee in addition mandatory EPF scheme. The same interest rate application to VPF and EPF. This will simply helps to increase the corpus amount of employee at the time of retirement or withdrawal.

What is PPF ?

PPF is Public Provident Fund. Those who are not salaried professional they can open a PPF account in any Bank. This is saving scheme helps to compound you money by the time. It is also provides Tax benefits. An employee can open PPF and save tax up to 1.5 lakh per annum as per old Tax regime.

Which amount reflects when employer file contributions ?

When employer file contributions a SMS triggered to employee mobile as EPF is submitted for the particular month. Employee can also check and verify by entering into EPF passbook.

How it helps a person to knowing about EPF contribution account details ?

When a person check EPF contribution account details , the he came to know that a specific amount is deposited into various account of Pension, PF and EDLI.

When a person can see the EPF account details ?

Once the EPF contribution is deposited by the employer , then a person can check the EPF contribution of previous month in his EPF account.

What is last date EPF contribution ?

EPF contribution is submitted on the succeeding month. As per the PF guideline, on or before 15th of the succeeding month PF contribution shall be deposited otherwise penalty is to be charged from employer.

What is TRRN number in EPF Contribution ?

TRRN is meant for Temporary return reference number. It helps to identify PF challan payment status. One can download it from PF website as PDF copy and verify it.

How TRRN helps PF ?

TRRN helps to identify whether contribution amount is deposited to EPFO or not. One cane check online how much contribution amount is deposited on what date.

What is wage month & what is return month?

Wage month is the Salary Month. It means the month in which employee earns salary at the end of a month. Return month is the consequent month in which PF contribution to be deposited.

What is EPF contribution account details ?

There is separate bank account in which EPFO accept money from employer while EPF contribution. When employer submit the money is deposited to separate bank account of Pension, Provident Fund and Insurance.

What is account 1 & account 2 in EPF ?

Account 1 is where 70% of monthly EPF contribution is retained. It is meant for old age retirement withdrawal after superseding 58 years of age.

Account 2 is where 30% of monthly EPF contribution is kept. It is meant for immediate withdrawal at the time of emergency.

What is account 1 & account 10 in PF ?

Account 1: In this account PF of both employee and employer is deposited.

Account 10 : In this account pension contribution given by employer is deposited.

Can we use 2 PF accounts ?

Yes, You can use 2 or multiple PF accounts but not in one time frame. New PF accounts are created when you join a new Organization. Every time you switch your job new EPF account is created under the same UAN number.

How can I manage 2 PF accounts?

You need not manage about 2 PF accounts. It is auto populated in your UAN account. You can check the EPF accounts by entering into your Passbook

Can an employee work in 2 companies ?

No, As per the EPF rule is concerned a person can not work in two different company. EPFO has created UAN (Universal Account Number) number which is linked to the Aadhar number of a person. When the PF deposited for the same person under different company, it automatically get rejected.

What happen if we don’t merge PF accounts ?

PF accounts does not merge. PF amount can be transferred from one account to another account. If do not transfer PF amount it get saved in the old account and do not attracts interest in that money.

Can I withdraw money from Account 1 ?

Yes, When an employee apply for PF withdrawal application then the particular amount is given from Account 1 because in Account 1 PF contribution amount of both employer and employee is deposited.

What is EPF Contribution Period ?

A month is considered as the Contribution period. EPFO receives EPF contribution every month from an establishment.

How to calculate Contribution of EPF ?

Calculation of EPF contribution is based on the working days. That means , in case of Fixed monthly salary, then only basic and DA will be considered. For Day wage earners, no. of days worked (Maximum 26 Days) multiplied with per day wages. Then 12% of Monthly basic and DA is calculated as Employee share and 13% of monthly basic and DA is calculated as the employer share.

How does Employer contribute to EPF ?

Contribution of EPF depends on the Basic and dearness allowance of the Employee. If an employee’s basic and DA is less than Rs. 15,000 then he is eligible for EPF member. If employee draws salary more than Rs. 15, ooo , in that case Employer consent is required for depositing of PF.

How nonpayment of PF contribution affects employee?

Provident Fund contribution amount can only be deposited by employer. If any case employer is unable to deposit that amount, then due amount will be regarded as arrear and non-payment of PF contribution is regarded as criminal offence.

Who will contribute on what rate?

In EPF contribution two party are involved. One is employee and other party is employer. Employer contribute at the rate of 13% of Salary and employee contribute at the rate of 12% of Salary

What is EPF admin Charges ?

EPFO charges a nominal fee from every employer during filling of contribution of PF. The purpose is to insure expenses like maintain office employees, process documentation, banking charges and others. 0.5% of Salary(Basic and Dearness allowance) is the admin changed of EPF.

What is percentage of PF contribution ?

To ease the contribution system towards PF a nominal percentage is calculated in accordance with basic and dearness allowance. Percentage of PF contribution varies. For employee it is different for employer it is different. Percentage is defined by the Central Government.

EPF Contribution 2023 :

In the Year of 2023, the rate of Contribution of EPF, EPS and EDLI is remain same. In Covid period employee share is reduced to 10% of Salary.

Possible Q&A :

What is the Salary ceiling for determining Basic Wage for Contribution of EPF ?

15,000 rupees per month as basic salary is the ceiling or limit to consider for PF Contribution eligibility.

If an employee drawing salary more than ₹15,000 per month then he can be eligible for PF Contribution subjected to employer contribution. Both employer and employee consents taken in PF declaration form.

Whether an employee can contribute to the pay exceeding Rs. 15,000?

An employee can contribute on the pay of more than Rs. 15,000, if there is a joint request from him and his employer to the PF authority and the employer agrees to pay the administrative charges on the differential amount also

Whether employer is liable to pay contributions even if wages are not paid ?

Yes. Even, if wages are not paid, the employer is liable to pay the Contribution.

Is the employer liable to contribute for the period of absence of an employee?

Employer is liable to pay contribution even for the period during which an employee is absent if he is paid wages for the said period.

What happens if contractor does not make EPF contribution timely ?

Contractor is a employer. It is controlled under Principal Employer. If contractor do not make EPF Contribution ,then Principal employer make payment to EPF and then such amount can be deducted from Contractor bill.

What is important in EPF Contribution?

An employee needs to understand whole provision of EPF. Generally important points in EPF contribution is how much percentage of contribution is allocated to which account.

What is the EDLI contributions ?

EDLI contribution is 0.5% of basic plus dearness allowance of employee. This amount of money is bearing by employer.

What is last Contribution ?

The contribution is paid by previous employer is called old contribution.