Comparison between EPF Mutual Fund

Are you interested to opt mutual fund instead of provident fund ?Are you confuse between EPF and Mutual Fund? Are you thinking to close your provident fund account shift all your money to mutual fund ?

Let us figure out Comparison between EPF Mutual Fund. How we can use this knowledge to improve financial discipline to produce growth of our money.

EPF results Secure Growth whereas Mutual Fund results risky growth.

Recently I came to know that one of my colleagues opt Mutual Fund by stopping his EPF from his Employer. He thought Mutual Fund is producing more return in comparison to EPF. Time will say whether his decision is correct or not. Because Mutual Fund is completely dependent on market risk.

And other factors are also responsible for getting money in hand at the time of withdrawal because annual fees of the broker cum demat account company, exit load & Admin Fees to the Fund Manger of the Mutual fund will be debited. At the time of closing Mutual Fund if Market crashes then we may end up with loss.

In other hand though return in case of EPF is limited still we are contributing only 12 % of our Basic salary and 12 % of employer contribution is free for us. This is simply my opinion in addition to EPF one must choose Mutual Fund separately, mostly SIP (Systematic Investment Plan) not in replacement of EPF.

In Comparison between EPF Mutual Fund first one safe and second one risky, first one is secure second one is volatile, first one is definite and second one ambiguous.

If above paragraph is not understood, then let us understand EPF and Mutual Fund separately and clearly.

What is EPF ?

EPF is Employee’s provident Fund. This facility is applicable only for an employee. In this facility or provision three party have important role to play.

- First: You as an Employee, who contribute certain portion of your salary on monthly basis.

- Second: Your Employer, who contribute the same amount that you contribute. In addition to that Government fees and Insurance premium is paid by employer.

- Third: Government pays compound Interest every year on your deposited amount.

As result you ended up with Lumpsum amount as Provident Fund, recurring income as Pension after retirement and Insurance amount given to your family members after your death.

What is Mutual Fund ?

In Mutual Fund is basically a basket where person like you and me, not necessarily employee deposit their money. The Fund Manager invest those money in the stock market as per his or her intelligence and experiences to grow this money.

Charges for official documentation and office administration of Fund Owner shall be bear by you. Growth and return of your money completely depend upon Market volatility.

Mutual Fund also depends upon three factor

- First: You, not necessarily as an employee. You can be self employed, business man.

- Second: Fund Owner, Who allocate your fund into various stocks of the stock market.

- Third : Stock Market, Ultimately it gives you return. The risk resides on the market volatility status.

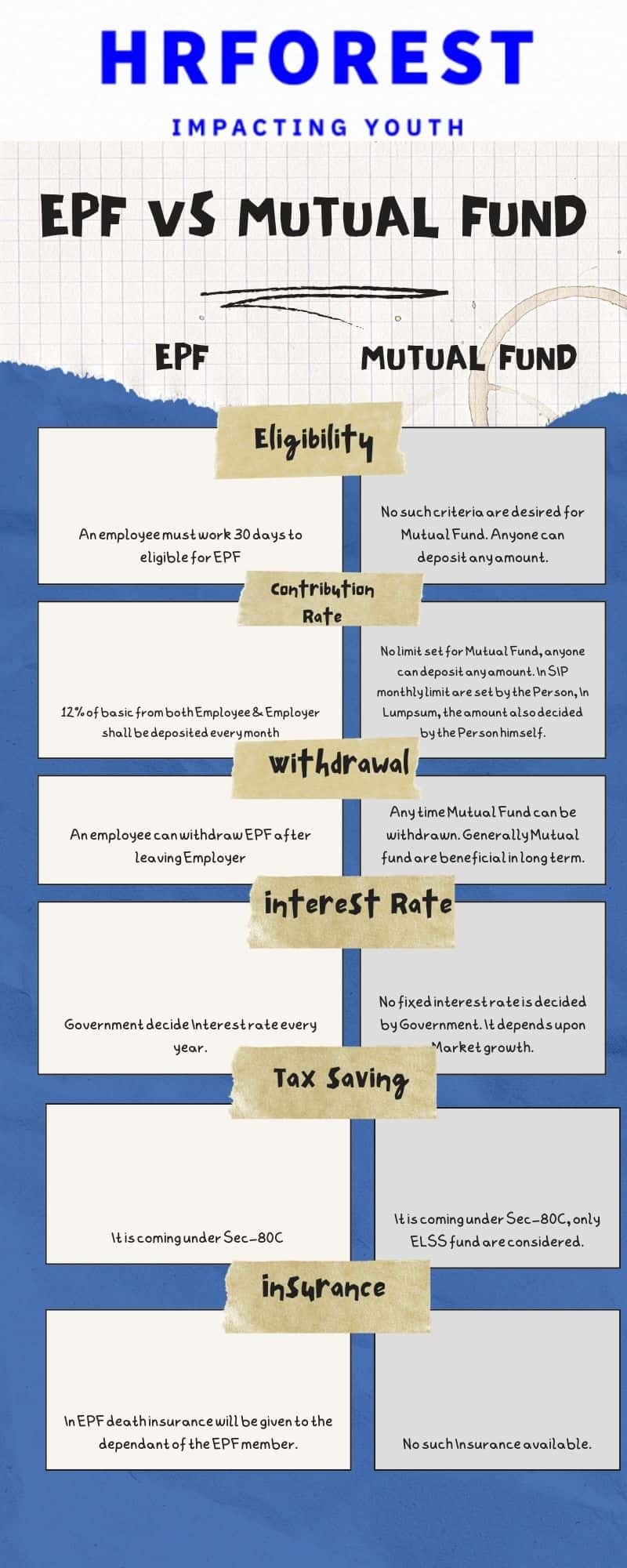

Check the below picture to understand Comparison between EPF & Mutual Fund.

Though Indian Economy is growing day by day, then there is the possibility that we will receive a good return if we invest our money in Mutual Fund. However, we should learn in which Mutual Fund we should invest. Not all the Mutual Fund are profitable.

Let me tell you rather than Mutual Fund we should invest in Index Fund where Official Charges & Exit Load money are equivalent to Zero. Any how I will prepare a separate article on Mutual Fund.

Table of Comparison between EPF Mutual Fund :

Now let us focus on below table to understand difference between EPF and Mutual Fund. You can figure out how the EPF and Mutual Fund differed in various criteria like Eligibility, Contribution, Interest rate, return or maturity etc..

| Key Points | EPF | Mutual Fund |

| Governing Body | Controlled by Government of India (Employee Provident Fund Organization) | Controlled by Fund Manager |

| Nature | It is statutory in nature | It is voluntary in nature |

| Contributing party | Bothe employee and employer are required for contribution. Employer also contribute extra for Insurance & Govt. Fees. | Employer is not required for contribution. Anyone can create Mutual Fund in Demat account in Bank & deposit it. |

| File Contribution | 12% of basic plus DA from both Employee & Employer shall be deposited every month | No limit set for Mutual Fund, anyone can deposit any amount. Contribution can be given as Lumpsum or SIP as per wish of the Person. |

| Eligibility | An employee must work 30 days to eligible for EPF | No such criteria are desired for Mutual Fund. Anyone can deposit any amount. |

| Withdrawal Time | An employee can withdraw EPF after leaving Employer | Any time Mutual Fund can be withdrawn. Generally Mutual fund are beneficial in long term. |

| Tax inclusion | For Government employee tax slab is 5 Lakh & for private employee’s tax slab is 2.5 lakh | Here also tax levied from the find lumpsum amount. |

| Interest Rate | Government decide Interest rate every year. | No fixed interest rate is decided by Government. It depends upon Market growth. |

| Tax saving | It is coming under Sec-80C | It is coming under Sec-80C, only ELSS fund are considered. |

| Insurance | In EPF death insurance will be given to the dependent of the EPF member. | No such Insurance available. |

| Employer Contribution | Here in EPF 12 % Employer Contribution is deposited in the EPF account of Employee by the Employer. | Here no such extra amount is given to the member. |

| Middleman Intervention | EPF is directly accessible to the member | Funds are only bought through Demat account |

| No extra Charges for Opening account | EPF neither demands any charge for Creating UAN or PF account nor in the time withdrawal money. | The demat account facilitator company charges you brokerage. The fund manager charges administration charges & Exit load from you. |

Related article:

Differences between PF and Mutual Fund

Main difference between PF and mutual funds is the source means PF is linked to EPFO and employer whereas Mutual Fund is linked to Share market. So PF is considered to secure and limited growth in contrast to Mutual Fund is regarded as unsecured and highly returned investment scheme.

Conclusion:

Separate benefits as well as loss lies on EPF and Mutual Fund. When EPF assures Less growth with high security whereas Mutual Fund returns high growth with high risk.

In my opinion both are to be used as per our financial goal. Specifically I can recommend invest in Index Mutual Fund because admin fees and exit load are less, so that more of your contribution can be invested in Index Fund.

I would love to read your feedback how this article helps you. Is the article readable, Is it worth to take your time, Please write your experience in the comment below.

Q&A

What is SIP on Mutual Fund ?

SIP is Systematic Investment Plan. Every month, quarter or year you fix an amount to pay to the Fund owner for investing. SIP may be voluntarily you pay at the due date or auto deducted from your bank account.

What is Exit Load on Mutual Fund ?

Exit load is the amount of money that you pay to you Fund manager of owner to carry out administrative activity of your fund. It is calculated in percentage. Certain percentage will be debited from your money at the time of withdrawal.

What is Demat account and how it helps ?

Demat account helps you buy and sell stocks and mutual funds. This account is created as per SEBI guideline. A middle man called broker under whom you can open a demat account. Broker may charge brokerage fees from you.

What is ELSS Fund ?

ELSS fund is noting but a Mutual fund which helps you to save income tax under Sec-80 C. Full form of ELSS is Equity linked saving scheme.

What is the interest rate of Mutual Fund ?

No specific interest rate is defined for mutual fund like EPF. It is completely dependent on Market condition. Generally, it varies from 8% to 12% as per the historical market condition of India.