How to send EPF money from Old account to New Account

Are you the one who try to know how to protect your money that you contributed each month into your EPF account, how to transfer safely your money from old account to new account, how pension amount is important to check and send to new account and relevant information.

I believe it is worthful to know if are a employee in any organized sector.

I have covered below all the desired information, and step by step procedure about How to send EPF money from Old account to New Account.

Concept of UAN & PF account:

Simple concept is multiple PF accounts are linked to a single UAN number for easy operation and control.

Background-Problem Side:

Before the year of 2014, both employee and employer were facing various petty problems related to EPF process and transaction. Let me jot down some of it,

Employee has multiple EPF & EPS account number when they switched one Establishment to another Establishment. In every account number their name, Father’s name, Date of Birth were mismatching.

Also read:

How to Check EPF balance in Passbook ?

How to complete e-Nomination in EPF Portal ?

Due to ambiguity of Data, EPFO officials found it difficult to execute certain formalities like withdrawal of money, transfer of money, payment of Pension after superannuation, payment to nominees after death of employee .

Employees and nominees used to approach employer to validate and correct the data and then EPFO officials passed the amount. Employer also wasting time and energy in this tiny things. Volume of documents to be maintained also increased for three of them.

How Aadhar card solving the problem?

At that time Aadhar card also solving the same problem in India. Different cards were used for different purpose in different sectors. Aadhar card is the only card who replaced all the other cards like Voter Card, Ration Card, Matric Certificate etc.

It became mandatory on pan India basis for identification of Individual, Identification of home address, Identification age and date of birth etc.

Solution side:

So the same pattern has been implemented to simplify the systems and procedure of EPF & EPS. A unique number is created and all the data like name, age, date of birth, nominee details, bank account number, mobile number etc. linked to it. Then EPF account number is linked to it.

When the correct data is verified and linked to UAN after verifying KYC documents, then nobody found difficulty in withdrawing EPF fund, transferring EPF and EPS fund, making payment of Pension etc. One click was required to fetch the data from UAN

Universal Account Number in short UAN, the concept came to effective after the year of 2014. EPFO wanted each employee has a unique number to which all the EPF account number shall be linked with.

Again this concept looks more easy when individual mobile number and Aadhar card get linked it. The problems like Name mismatch, date of birth mismatch get removed automatically. Authenticity and security of EPF is ensured ,when auto generated OTP (One Time Password) used at the time of transaction.

Why to send EPF money from Old to new PF account ?

Your money in the old account get inactive and dormant if it is not sent to new account. No compound interest is attracted to that fund and so growth stopped. If the old amount mixed into new amount in new account, you will get the compound interest on whole amount.

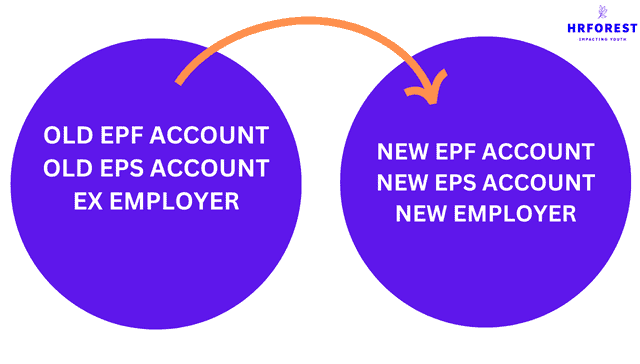

When a employee joins an establishment his/her UAN number and EPF EPS account number is created and linked to to each other. Contribution is filled and that EPF number became active.

When employee switches to new establishment for growth by changing job, his/her new employer creates new EPF and EPS account number and start filling contribution and make that account active.

So now the question is what is about the money deposited in old EPF account ?

The old account became inactive ,when contribution stopped. Money in the account remain unaltered, interest is not attracted to that money

What happens to EPF money if not transferred to new account?

If the EPF money is not transferred to new account , that account become dormant and inactive. if it continues for a long time, it will be declared as NPA ( Non Performing Account) and all the money on that particular account get converted to government property.

When to send money to new account ?

When a employee leave the old establishment and join new establishment, after passing of three months of left date of old establishment the application for sending money to new account from old account shall be applied.

Both the employer and EPFO does not update immediately after employee leave the job. They take some time to calculate other elements like, how many days of notice period served, gratuity amount if applicable, no dues clearances for ensuring authentic exit of employee. finalization of last date of working etc.

If EPFO finds , no new account is created and contribution stopped in old account by tracking UAN, then it understood that the particular employee is unemployed. So withdraw of fund in old EPF account is possible after passing of three month from the date of exit the job.

How to send EPF money from Old account to New Account ?

Sending of EPF money of EPS money from old account to new account is only accessible and possible through UAN portal. Form-13 ,PF transfer request form is to be filled by clicking on One Member-One EPF(Transfer Request) in the UAN portal home page.

Step-by-step guide is given below,

Step-1 : Go to Google and search EPFO home page and open UAN portal.

Step-2: Click on Online Services from extreme right of the task bar.

Step-3 : Click on One Member-One EPF(Transfer Request)

Step-4 : Enter current EPF account Number given by new employer after joining.

Keep handy all the required information, Ensure authenticity before entering data

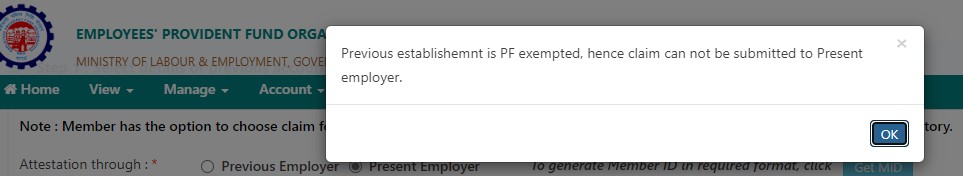

Step-5 : Select details of previous accounts number, old EPF & EPS account, Click on attestation through ( Previous Employer/ Present Employer). It is suggested to get attestation through present employer for smooth access.

- Choose only ‘Previous Employer‘ if the EPF of the establishment is running under Trust.

Step-6 : Enter your 12 digit correct UAN Number & click on Get Details to fetch the data.

Step-7 : When the details of Previous establishment open, click on the chose button.

Step-8 : Go to Authenticate OTP & Submit. OTP will be sent on Aadhar linked mobile number, verify authenticity by entering OTP .

Step-9 : After final submission of Online Form-13, download the PDF copy of the Form & full name sign on the member column.

Step-10 : Send the copy to your Previous Employer or Present Employer. It is suggested to get attestation through present employer for smooth approach and speed process.

Step- 11 : Track the status in the Track claim Status(Online services column)

Step-12 : At the first stage first claim shall be approved by Previous Employer/ Present Employer.

Step-13 : Then at the second stage it shall be approved by Field Officer.

Step-14 : After Field officer approval your fund will be automatically transferred to Current account.

What needs to be followed before applying transfer request ?

Before applying transfer requesting form at least five points mentioned below,

- Date of exit of EPF and EPS shall be maintained correctly.

- All KYC details and authentic documents shall be uploaded in the UAN portal.

- Nomination of employee shall be completed.

- Old PF amount get settled from previous employer to RPFC.- You can check with your passbook.

- Communication with HR Executive or Finance executive of the present employer as well as previous employer.

How many days to take to send EPF money ?

It is difficult to say the actual time required to complete the whole process because it varies case to case. Usually 2 to 3 months is required for approval in various stage.

What are the documents required sending EPF money from old to new PF account ?

If the UAN is activated before you applying transfer request or sending EPF money from old account to new account, then no problem arise. Please ensure all the KYC documents like Aadhar card, Pan card, Bank account number shall be updated.

Your mobile number shall be linked to your Aadhar number. It will help you receive OTP on registered mobile number and by entering OTP you can verify the application form and submit.

Conclusion :

I hope I have covered the fundamental information about How to send EPF money from Old account to New Account. I expect by reading this article helped you to collect correct information and process to follow and take appropriate action to get the job done.

Feedback :

I would love to know what is running in your mind after reading this article. I wait your feedback in the comment section. This feedback is valuable as it helped me to improve and encourage me to write new content as per choice and requirements of my reader.

Q&A

What is NPA ?

It is better called Non Performing Account. Any account which is dormant and inactive due to non filling of contribution or non transferring of fund that money in that inactive account declared as NPA. The account is under the custody government and amount is transferred to government fund.

What is KYC ?

Know your Customer is abbreviated as KYC. By virtue of this an EPF member need to update all the information of Aadhar, PAN, bank account, mobile number, name and address of nominee and upload the valid documents in UAN portal.

This helps to refrain from ambiguity of personal data at the time of withdrawal transaction.

What is OTP ?

A six digit unique number receive to you registered mobile number at the time of applying any claim in EPFO. This password is applicable for one time for certain time period. This helps to safety and security of your claim.

This is completely private as only you can receive in your mobile number. Do not try to share it with others, then only your claims can be compromised.

What is RPFC ?

Full for RPFC is Regional Provident Fund commissioner. When your PF account closed by your old employer then it is the duty of employer to calculate all the contribution and interest amount accumulated and send to regional Provident fund commissioner office.

The RPFC is responsible to show that amount in you passbook and that amount will be sent to your new PF account.

What is Passbook in EPF ?

It is like personal diary of your EPF account. All your transaction like withdrawal claim amount, transfer claim, date of claim settlement, date of exit from old employer, date of joining of new account etc. get recorded.

How to link mobile number to Aadhar ?

You can update mobile number by visiting Postal Service website link. You need to provide all your information like your name and address, you Aadhar number, your mobile number, your email id etc. Select UIDAI-mobile for Aadhar linking and update.

It is necessary and important to link your personal mobile number with your Aadhar number because it is not only required in EPF claim process but also essential in other platforms for ensuring your privacy and safety.